EVENT INFORMATION

Insurance Investor Live | Europe 2025 and the co-located Insurance Investor | European Awards, is the premium annual gathering for the European community of insurance investment, treasury, capital management, and risk, accounting, and investment operations leaders, alongside renowned industry experts.

Dedicated to the full decision-making unit in insurance asset and capital management, the Insurance Investor Live | Europe summit offers insights and key learning opportunities across three core streams: Treasury Management & Capital Risk, Investment Operations, Compliance & Reporting, and Asset Allocation, Investment Strategy, and ALM Leadership.

The second annual awards programme will reconise excellence amongst insurance investment teams, third-party asset management, investment consulting, and fund services and solutions. Click here to read the summary of the 2024 awards.

Further details coming soon.

KEY BENEFITS OF ATTENDING IN-PERSON

Benefit 1

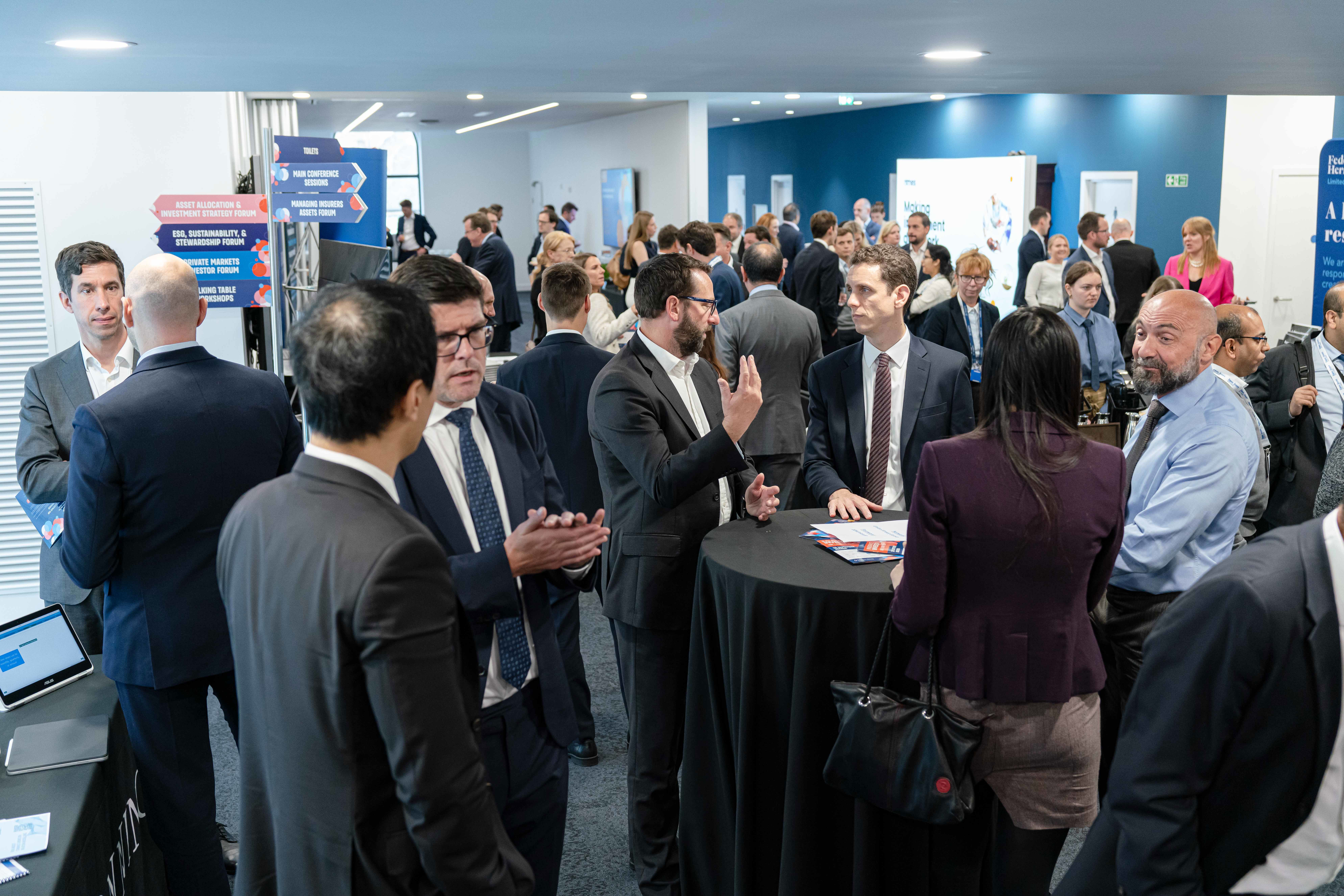

In person networking

Meet like-minded professionals and industry innovators from across the European insurance investment, treasury, capital, and risk management sector, providing a fantastic opportunity to connect and engage with fellow insurance leaders.Benefit 2

Engage with industry experts

Have the chance to raise questions with our expert speakers during audience Q&A and designated networking breaks, as well as an opportunity to gain insight into the thoughts and aspirations of your peers.Benefit 3

Focused agenda and prestige speakers

Your chance to hear from a prestigious line-up of speakers including insurers, regulators, economists, and academic institutes on the hottest industry topics to get first-hand insights, first, to create your market advantage.Benefit 4

Content opportunities

Have your chance to raise questions with our expert speaker line-up, through live presentations, panel debates, plus our unique group based Talking Table Workshops, for enhanced learningopportunities and to inspire new ideas to drive forward your asset management activities.

INDUSTRY PROFESSIONALS IN ATTENDANCE

EUROPEAN ADVISORY BOARD MEMBERS